HMRC LOGIN and Self Assessment

Let’s delve deeper into the intricacies of these services, highlighting their features and benefits, with a special focus on the HMRC login process. In an era where digitalization is at the forefront, the HMRC has embraced this transformation, offering a myriad of online services to facilitate a smoother, more efficient tax management process. Whether you are an individual grappling with your Self Assessment tax return or an employer overseeing a PAYE scheme, HMRC’s digital platforms are here to simplify your journey.

Your Digital Journey with HMRC Login

Before you immerse yourself in the digital services offered by HMRC, it’s essential to understand the preliminary steps. Primarily, you would need to authenticate your identity, a process facilitated through the Government Gateway. This gateway serves as your digital ID, a passport to a range of services designed to streamline your tax affairs, making the HMRC login a vital step in your digital tax journey.

Interactive Assistance: Digital Assistants and Webchat

Imagine having a virtual assistant at your disposal, ready to guide you through the labyrinthine corridors of tax matters. HMRC offers just that – digital assistants and webchat facilities to aid users in various tax-related queries. Depending on the specific tax service you are navigating, you might encounter:

- Digital Assistants Only: These are automated bots programmed to assist you with general queries .

- Digital Assistants and Webchat Combo: A blend of automated responses and live chat options to provide a comprehensive support system .

- Live Webchat Only: Direct interaction with a human representative for more complex queries.

HMRC is in the process of expanding these functionalities, aiming to cover a broader spectrum of areas, enhancing the user experience.

Community Forums: Your Virtual Discussion Room

In the digital realm of HMRC, you are not alone. The community forums hosted by HMRC serve as a vibrant space where individuals and businesses can engage in discussions on a wide array of tax topics. These platforms allow you to:

- Post Questions: Share your queries and receive answers from HMRC.

- Record Keeping: Maintain a record of the online chat to avoid any discrepancies regarding the discussions or agreements made.

- Collaborative Learning: Learn from the experiences and queries of other community members, fostering a collaborative environment.

Your Gateway to Digital Services: HMRC Login

Embarking on your digital journey with HMRC begins at the GOV.UK website, a central hub that grants you access to a plethora of services. Here, you can explore:

- Personal Tax Account: A virtual account to manage your tax affairs, akin to an online banking portal but exclusively for taxes, accessible after you log in HMRC platform.

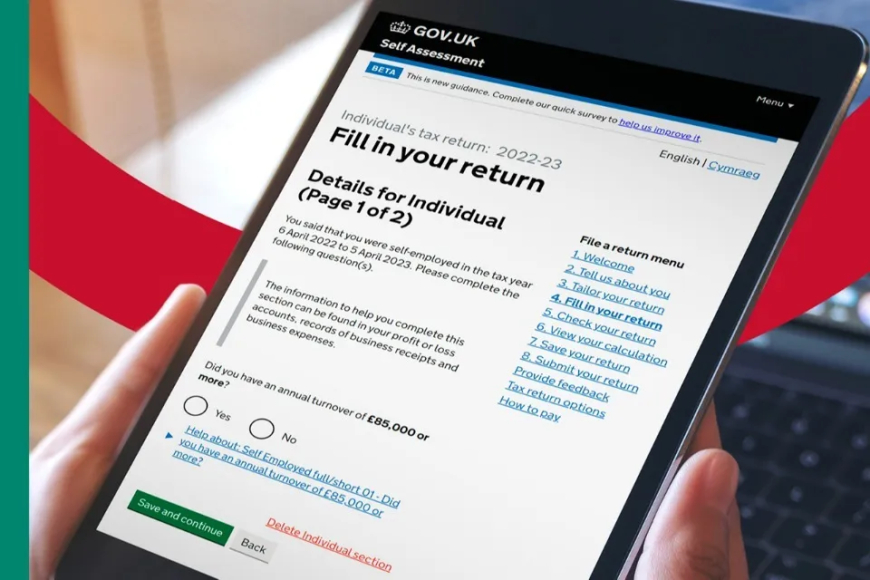

- Self Assessment Online: A platform to file your Self Assessment tax return seamlessly, a service available through HMRC login.

- HMRC Mobile App: An interactive application that lets you manage tax credits, check your income tax for the current year, and track the status of submitted tax forms, all from the palm of your hand after your HMRC login.

Government Gateway: Log in HMRC’s platform

The Government Gateway acts as a central platform, a digital passport that allows users to register and utilize online government services. This gateway is your key to a world of streamlined tax management services, facilitating a seamless HMRC login process. The registration process is a guided journey, leading you step-by-step through the nuances of signing up for popular services such as the Self Assessment online service.

Personal Tax Account: Your Virtual Tax Manager

Imagine having a personal manager to oversee your tax affairs, available at your fingertips. The Personal Tax Account is designed to be just that. This virtual platform offers a range of services and functionalities, after you pass the HMRC login:

- Address Management: Update your address details with ease.

- Income Tax Check: Keep tabs on your income tax for the current year, available after you log in HMRC‘s system..

- Tax Credit Management: Manage your tax credits efficiently, with a user-friendly interface, accessible through the HMRC platform.

Assisted Digital: Bridging the Digital Divide

In a world that is rapidly digitalizing, it is vital to ensure that no one is left behind. HMRC’s Assisted Digital support is a testament to this commitment, offering assistance to individuals who may face barriers in accessing online services. Whether it’s a lack of internet access, limited digital skills, or a lack of confidence, this service is here to bridge the gap, ensuring that everyone can navigate the digital tax landscape with ease, with the support of HMRC’s digital platform.

Additional information can be found on the HMRC’s Website.

What's Your Reaction?